With an increasing number of businesses adopting , the business world is on a quest for a new way to handle digital assets. Typically, organizations have depended on centralized wallets managed by third-party suppliers.

But now, more and more companies are moving from centralized wallets to decentralized wallets. In 2024, crypto platform hacks stole $2.2 billion, a 21% increase from the previous year’s $1.8 billion. In addition, centralized services were the primary targets in Q2 and Q3 of 2024. However, incidents such as Japan’s DMM Bitcoin losing over $305 million in May and India’s WazirX losing $235 million in July stands out.

However, traditional centralized wallets, despite their convenience, bring security risks and operational constraints. On the other hand, decentralized wallets enhance security by removing risks of single points of failure. This allows for more control over a business’s assets.

In this article, we will elaborate on why businesses are moving away from centralized wallets and opting for the best decentralized crypto wallet solutions.

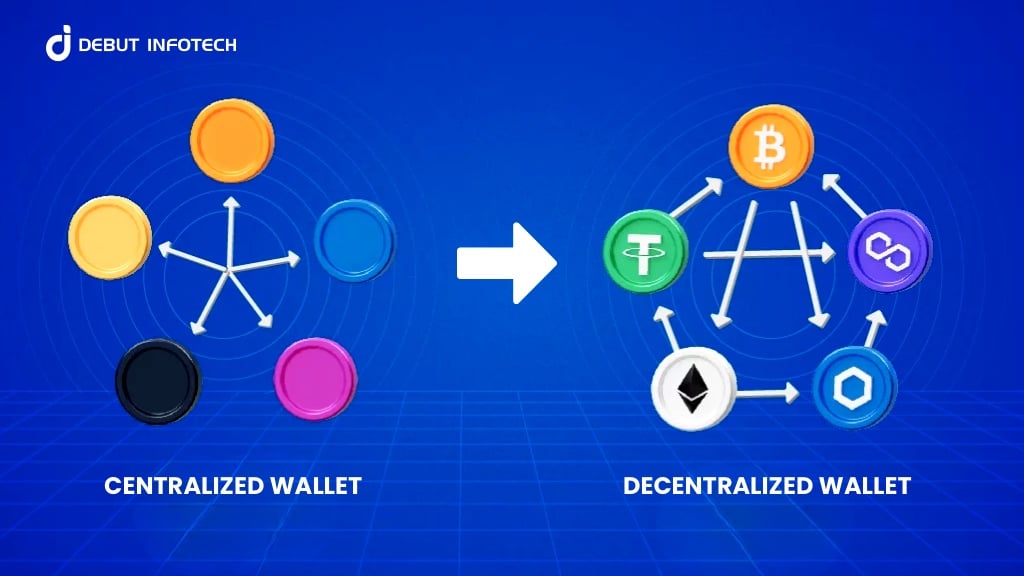

Understanding Centralized and Decentralized Wallets

Centralized Wallets: Features and Limitations

Centralized wallets are managed by third-party service providers, such as exchanges or financial institutions that store private keys on behalf of users. This setup offers ease of use and built-in recovery options but comes with security concerns. As enterprise and end users contemplate the future of centralized wallet ecosystems, it should be understood that centralized wallets are a common target for cyber hacks, and users must have faith these entities will protect users’ assets.

Decentralized Wallets: A New Standard in Digital Asset Management

In contrast to centralized wallets that hold user’s private keys, decentralized wallets give users ownership of the private keys, thus eliminating third-party involvement.

Transactions are settled directly on blockchain networks, enhancing security and transparency. By reducing counter-party risk and providing greater robustness to external threats, decentralized wallets are a more attractive option as compared to their centralized counterparts. This makes it the best choice for businesses that value higher security and autonomy.

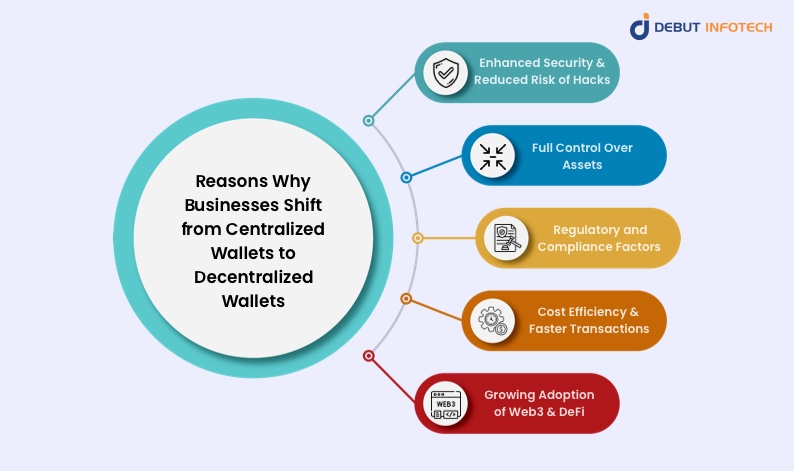

Reasons Why Businesses Shift from Centralized Wallets to Decentralized Wallets

1. Enhanced Security & Reduced Risk of Hacks

Businesses have lost billions of dollars due to security incidents and breaches on centralized platforms. A cryptocurrency wallet development company can help enterprises build decentralized wallets that eliminate single points of failure, ensuring owners have full control over their assets. Using private key management, enterprises can avoid the risk of attacks and limit their dependency on third-party security measures.

2. Full Control Over Assets

Businesses that rely on centralized services must adhere to platform policies and potential withdrawal restrictions. Decentralized wallets grant full ownership and control, allowing companies to manage their assets without limitations. This level of autonomy is particularly valuable for organizations operating in global markets, where financial regulations and banking access vary.

3. Regulatory and Compliance Factors

As governments increase scrutiny on centralized exchanges and financial services, businesses must adapt to evolving regulations.

Decentralized wallets align with privacy-focused frameworks, which is why a white label crypto wallet can be a valuable solution. It helps businesses stay compliant with data protection laws and minimizes the risks from potential regulatory intervention. The ability to manage funds independently also helps organizations navigate uncertain regulatory environments more effectively.

4. Cost Efficiency & Faster Transactions

Centralized platforms can charge high transaction fees, especially for high-volume businesses. With decentralized wallets, you can transfer from one peer to the other without the need for third parties. This lowers the fees associated with the transaction. Moreover, this translates into better processing speed for settlements, thereby improving operational efficiency with fast blockchain-based payments.

5. Growing Adoption of Web3 & DeFi

The emergence of Web3 and (DeFi) is transforming how businesses operate. A great number of enterprises are incorporating blockchain-powered financial services in which they need Decentralized wallets that interact with smart contracts and decentralized applications. As businesses explore tokenized assets, digital identity solutions, and on-chain financial instruments, decentralized wallets become essential tools for seamless integration into the emerging digital economy. In addition, crypto trading bot development is gaining traction, enabling automated and efficient trading strategies within this evolving financial landscape.

Real-World Use Cases

The adoption of decentralized wallets is no longer limited to crypto enthusiasts—businesses across various industries are integrating them to enhance security, streamline transactions, and gain financial autonomy.

Here are some examples of real-world use cases of decentralized wallets:

1. Businesses Adopting Decentralized Wallets for Financial Autonomy

Many companies, especially in the financial sector and e-commerce, have adopted decentralized wallets in order to have full control of their assets. Self-custodial solutions have particularly gained traction with crypto-native businesses, including investment firms and blockchain companies, who commonly wish to manage large sums of crypto while sidestepping third-party platforms. As they eliminate the risks associated with centralized exchanges, these companies reduce their exposure to security breaches, withdrawal restrictions, and potential regulatory actions. This shift ensures uninterrupted access to funds and greater flexibility in financial operations.

2. E-commerce and Merchants Accepting Crypto Payments

Decentralized wallets are gaining prominent adoption amongst some of the world’s largest eCommerce companies and service providers.

In contrast to centralized payment gateways that charge high processing fees and impose settlement delays, decentralized wallets enable direct peer-to-peer payments with lower costs and near-instant execution. This is especially beneficial for businesses in areas that do not have stable banking systems: they can easily transact all over the world.

Major e-commerce platforms and independent merchants alike are leveraging decentralized wallets to improve transaction efficiency and reach a broader customer base.

3. Gaming and Metaverse Companies Leveraging Digital Ownership

The gaming and metaverse sectors have emerged as advocates for decentralized wallets, using them to enable in-game economies, facilitate non-fungible token (NFT) transactions, and claim ownership of digital assets. Games built on blockchain technology need secure, self-custodial wallets to allow players to store and exchange virtual assets themselves. By integrating decentralized wallets, these platforms empower users with complete ownership of their in-game earnings and collectibles. This model enhances trust and transparency, fostering long-term engagement among players and digital asset investors.

4. Supply Chain and Enterprise Use Cases

Enterprises involved in global trade and logistics are turning to decentralized wallets to streamline cross-border payments and supplier transactions. Traditional financial systems often involve intermediaries that add complexity and costs to international transactions. By adopting decentralized wallets, businesses can process payments directly on blockchain networks, reducing settlement times and minimizing reliance on banks. This approach enhances transparency, allowing companies to track financial flows with greater accuracy. Some logistics firms are also experimenting with tokenized payments and smart contract-based settlements, improving efficiency in supply chain operations.

Challenges and Considerations

1. Security Responsibility Shifts Entirely to Users

Decentralized wallets eliminate reliance on third parties, but they require businesses to manage their own security. Losing access to private keys can result in irreversible asset loss. Without centralized recovery options, companies must implement strict key management policies to protect their digital assets from human error or cyber threats.

2. Risk of Lost Access (Private Key Management)

Unlike centralized platforms that offer password recovery, decentralized wallets place full responsibility on users. Businesses must ensure private keys are securely stored and accessible to authorized personnel. Without proper key management solutions, companies risk losing funds permanently, making it essential to implement multi-signature wallets and secure backup strategies.

3. Adoption Barriers for Non-Tech-Savvy Businesses

Decentralized wallets require a technical understanding of blockchain operations, which can be a barrier for businesses unfamiliar with the technology. It is also crucial to understand the difference between a crypto wallet vs exchange because businesses need to know how to best store and manage digital assets.

Training employees, integrating secure processes, and selecting user-friendly wallet solutions are necessary steps. Overcoming these challenges ensures that companies can fully leverage the benefits of decentralized financial systems.

Future Outlook

Here are some decentralized Wallet trends to watch out for:

1. Decentralized Wallets Will Become Industry Standards

As blockchain adoption grows, decentralized wallets will transition from niche tools to mainstream financial solutions. Businesses will increasingly integrate them for transactions, asset management, and financial autonomy. Companies that adopt early will gain a strategic advantage, benefiting from enhanced security, lower costs, and greater control over their digital assets.

2. Advancements in User-Friendly Security Solutions

To address challenges like private key management, new security innovations will emerge. Multi-signature wallets, biometric authentication, and decentralized recovery solutions will enhance usability. As businesses demand more user-friendly options, ewallet app development will play a key role in creating secure, accessible solutions. These improvements will lower entry barriers, making decentralized wallets more accessible to businesses of all sizes while maintaining the security advantages that decentralization offers.

3. Hybrid Models Combining Centralized and Decentralized Features

Businesses may adopt hybrid wallet models that merge decentralization with the convenience of traditional finance. These solutions could offer user-friendly interfaces while ensuring self-custody of funds. Such models will provide businesses with regulatory compliance, operational flexibility, and secure asset storage without the risks associated with fully centralized platforms.

4. Regulatory Clarity Will Drive Adoption

Governments and financial authorities are gradually defining legal frameworks for blockchain and digital assets. As regulations become clearer, businesses will be more confident in integrating decentralized wallets into their operations. This clarity will reduce uncertainty, encourage institutional adoption, and support the long-term viability of decentralized financial ecosystems in global markets.

Conclusion

To boost security, lower costs, and gain complete control over their assets, businesses are opting for decentralized wallets more and more. While issues such as private key management plague decentralized wallets, the long-term benefits outweigh the risks. With the evolution of the financial ecosystem, decentralized wallets would be crucial to the future of business transactions as they provide a safe, secure and efficient alternative to traditional financial mechanisms.

Disclaimer: The views and opinions expressed in this article are those of the authors and do not reflect those of Geek Vibes Nation. This article is for educational purposes only.

Caroline is doing her graduation in IT from the University of South California but keens to work as a freelance blogger. She loves to write on the latest information about IoT, technology, and business. She has innovative ideas and shares her experience with her readers.