Short-term trading in BTCUSDT has surged in popularity as traders aim to capitalize on rapid price fluctuations. Unlike long-term investing, short-term analysis demands swift decision-making, precision, and adaptability to intraday trends. For those interested in optimizing profits, understanding these dynamics is essential. Platforms have contributed to broader blockchain adoption by providing high-speed, reliable trading environments. This article explores actionable insights, practical techniques, and tools necessary to master short-term BTCUSDT trading.

Understanding Short-Term Analysis in Cryptocurrency Trading

Short-term analysis focuses on assessing BTCUSDT price movements over hours or days rather than weeks or months. This approach differs from long-term analysis, which relies heavily on blockchain fundamentals and macroeconomic trends. Short-term trading thrives on volatility, which presents opportunities to capture small but frequent price swings. Objectives in this style often include minimizing overnight risk, exploiting momentum, and taking advantage of market inefficiencies. Traders seek to maximize short-term gains while maintaining discipline, as the rapid pace increases exposure to potential losses. Properly executed short-term analysis provides clarity, allowing for timely entries and exits that can outperform longer-term strategies during volatile market conditions.

Key Indicators for Short-Term BTCUSDT Trading

Technical indicators are essential tools for identifying profitable trades in short-term BTCUSDT strategies. Moving Averages (MA) and Exponential Moving Averages (EMA) track trends and highlight crossover points, while the Relative Strength Index (RSI) gauges overbought or oversold conditions. The Moving Average Convergence Divergence (MACD) detects momentum shifts, and Bollinger Bands signal volatility expansions or contractions. Volume oscillators confirm the strength of price movements. According to CoinGecko, which tracks over 13,000 cryptocurrencies and 650+ exchanges, combining multiple indicators increases reliability, especially on platforms like zoomex.com that provide real-time data and low-latency execution.

Key indicators include:

- MA/EMA: Trend direction and crossovers

- RSI: Overbought or oversold conditions

- MACD: Momentum shifts and trend reversals

- Bollinger Bands: Volatility expansion and contraction

- Volume Analysis: Confirmation of price moves

Chart Patterns and Candlestick Analysis

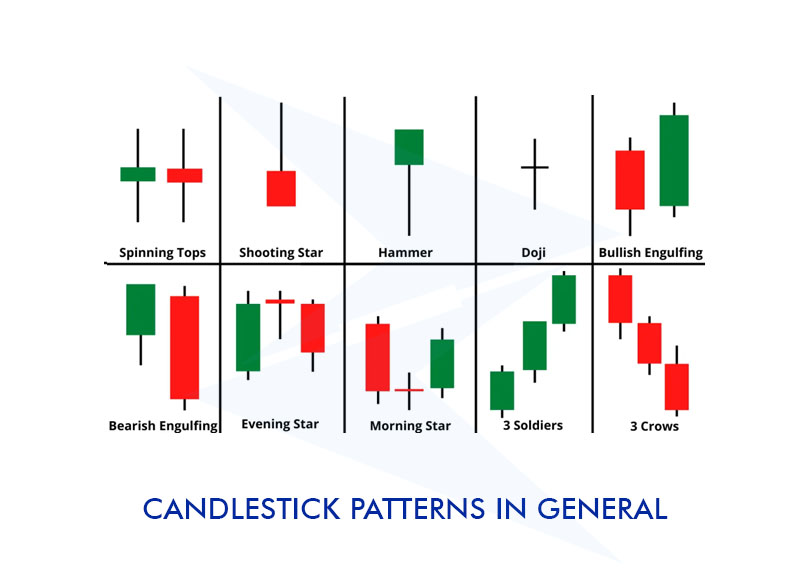

Recognizing chart patterns is critical in short-term trading because they provide insight into potential price movements. Patterns such as flags, pennants, wedges, double tops, double bottoms, and head and shoulders help anticipate continuation or reversal scenarios. Candlestick analysis complements these patterns by offering immediate market sentiment cues. Traders rely on specific formations to identify buying or selling opportunities. By combining chart patterns with candlestick insights, short-term traders can improve timing and accuracy in volatile BTCUSDT markets.

Pattern / Candlestick | Interpretation | Short-Term Signal |

Bullish Engulfing | Buying pressure increases | Potential entry point |

Bearish Engulfing | Selling pressure increases | Potential exit or short |

Bull Flag | Continuation of upward trend | Buy on breakout |

Double Top | Reversal pattern | Sell or short near resistance |

Wedge Formation | Trend reversal potential | Watch the breakout direction |

Timing Your Trades Using Short-Term Analysis

Timing is crucial in short-term BTCUSDT trading, as even minor delays can affect profitability. Intraday charts, including 1-minute, 5-minute, 15-minute, and 1-hour intervals, provide insights into micro-trends. Effective risk management relies on precise timing to place stop-loss and take-profit orders. Traders must also consider high-impact news events that can create sudden price swings. Monitoring trading volume and volatility helps determine optimal entry and exit points. Using these tools ensures that trades align with prevailing market momentum, reducing exposure to unexpected losses.

Risk Management and Position Sizing

Short-term trading carries inherent volatility, making disciplined risk control essential. Traders can protect capital using stop-loss orders and adjusting position sizes based on account balance. Calculating risk-reward ratios, such as 1:2 or 1:3, allows for consistent profit targeting while limiting losses. Emotional control is equally important, preventing impulsive decisions or over-leveraging. Maintaining disciplined risk management ensures long-term profitability, even in markets prone to sudden reversals. Structured approaches to position sizing and risk assessment give traders the confidence to exploit short-term opportunities without compromising overall portfolio health.

Leveraging Trading Tools and Platforms for Short-Term Gains

Advanced tools enhance short-term BTCUSDT trading by providing speed and accuracy. Charting platforms with real-time data, automated alerts, and algorithmic trading bots facilitate timely trades. Low-latency execution is particularly beneficial when capturing rapid price movements. Platforms offering USDT and coin-based contracts, such as Zoomex, provide high liquidity, fast execution, and access to diversified trading strategies. Spot and contract trading, along with copy trading options, accommodate both beginners and advanced traders. A secure and reliable platform enhances decision-making, allowing for efficient strategy implementation and better overall performance.

Strategies for Optimizing Short-Term BTCUSDT Trades

Short-term strategies focus on maximizing gains within volatile market conditions. Scalping involves quick trades to capture small, frequent profits. Momentum trading leverages short-term price spikes for rapid gains, while breakout trading targets positions once key support or resistance levels are surpassed. Integrating technical indicators, chart patterns, and risk management enhances the effectiveness of these strategies. Traders should adjust their approach based on prevailing market conditions, whether bullish, bearish, or sideways, to maintain a tactical advantage. Consistent evaluation and adaptation to price action improve the potential for repeatable profits.

Advanced Tips for Enhancing Short-Term Trading Accuracy

Refining short-term trading performance requires understanding broader market dynamics. Tracking BTCUSDT correlations with wider cryptocurrency trends helps anticipate directional moves. Analyzing order book depth and liquidity improves execution quality. Avoiding overtrading preserves capital for high-probability setups. Volatility analysis plays a key role in decision-making, identifying periods ideal for entering or exiting positions. High-volatility periods present significant profit opportunities, while low-volatility periods may require patience and strategic waiting. Advanced planning and careful observation increase trade efficiency and reduce unnecessary losses.

Zoomex – Empowering Short-Term BTCUSDT Traders

Zoomex is designed to support fast-paced trading strategies. It offers USDT and coin-based contracts with ample liquidity, spot and copy trading features, and 24/7 multilingual support. Multi-layer security and low-latency execution ensure a safe trading environment even during volatile conditions. Users gain access to instant deposits, real-time charts, and a variety of trading pairs suitable for arbitrage or hedging. The platform emphasizes user-first design, integrating simplicity, transparency, and reliability. For short-term traders, these features provide an edge in executing precise strategies and maximizing profits efficiently.

Conclusion

Short-term analysis is vital for capturing rapid BTCUSDT price movements. Effective trading combines technical indicators, chart patterns, precise timing, risk management, and a capable platform. Utilizing these tools strategically enhances the potential for consistent short-term gains. Platforms such as Zoomex offer the speed, liquidity, and security necessary for executing high-frequency trades successfully. Discipline, strategic planning, and ongoing learning remain essential for sustainable success. By implementing these practices, traders can navigate volatility and achieve meaningful profits in BTCUSDT markets.

Caroline is doing her graduation in IT from the University of South California but keens to work as a freelance blogger. She loves to write on the latest information about IoT, technology, and business. She has innovative ideas and shares her experience with her readers.